ESG regulation redefines business game rules: How does it affect business in the age of sustainability?

Rising concerns about climate change are bringing new rules to the game. It does not matter where we look, the impact is everywhere, and it is affecting all of us. Both in our daily lives and professional ones. Sooner rather than later going “green” will be mandatory, and not only a conscious way to do business. There are rules, norms, standards and politics of ESG, and in the incoming years, there will be more. This will, inevitably, impact how we do business, how the transactions are closed, and which assets will be considered eligible in the future.

Would you like to know more about how it is affecting your business? And, how your business is affecting climate change?

A regulatory framework is established by the EU Taxonomy regulation to classify economic activities according to their contribution to environmental sustainability. The idea of the EU Taxonomy Regulation is to transition to a greener and more sustainable economy by providing clarity, transparency and consistency on what constitutes ESG. It covers a wide range of economic sectors and activities within six different objectives, initially focusing on:

- Climate Change Mitigation (CEE)

- Adaptation to Climate Change

The regulation (Decree 2021/2178) and other related initiatives -such as Sustainable Finance Disclosure Regulation (“SFDR”) and the Non-Financial Reporting Directive (NFRD)- establish criteria that economic activity must meet to be considered environmentally sustainable within each objective. It includes disclosure obligations for financial market participants (asset managers, insurance companies, pension funds, and investment advisors). They are required to disclose to which extent their investments align with the EU Taxonomy. Adopted in 2020, it came into effect in July 2021, and it includes a phased implementation. Large companies listed on the EU regulated markets are required to disclose their taxonomy alignment starting from 2022, while smaller companies (<250 employees) will follow in 2023. Nevertheless, the regulation will be progressively extended to cover additional sectors and objectives in the future.

Bearing in mind that the EU’s goal is becoming climate-neutral by 2050 soon, for example, asset portfolios will have to include fewer high-energy-consuming assets/companies that do not fulfil the existing norms. On one end this will create the opportunity for the high liquidity investors that can buy and refurbish the asset/restructure the company, on the other asset owners/managers will be required to have certain knowledge about each of their assets when it comes to ESG.

The consequence of not complying with the existing sustainability norms and regulations is and will not only be related to reputation and brand value but also to the regulatory landscape and risk management. On the contrary, being “green” will not only allow a company to have a better reputation but will also provide access to a variety of economic incentives and the possibility to access the green loan market (loans, bonds, mortgages…)

Now, how can Deyde DataCentric help mitigate risks related to the ESG regulatory environment?

Climate Change Mitigation 2023 (CEE)

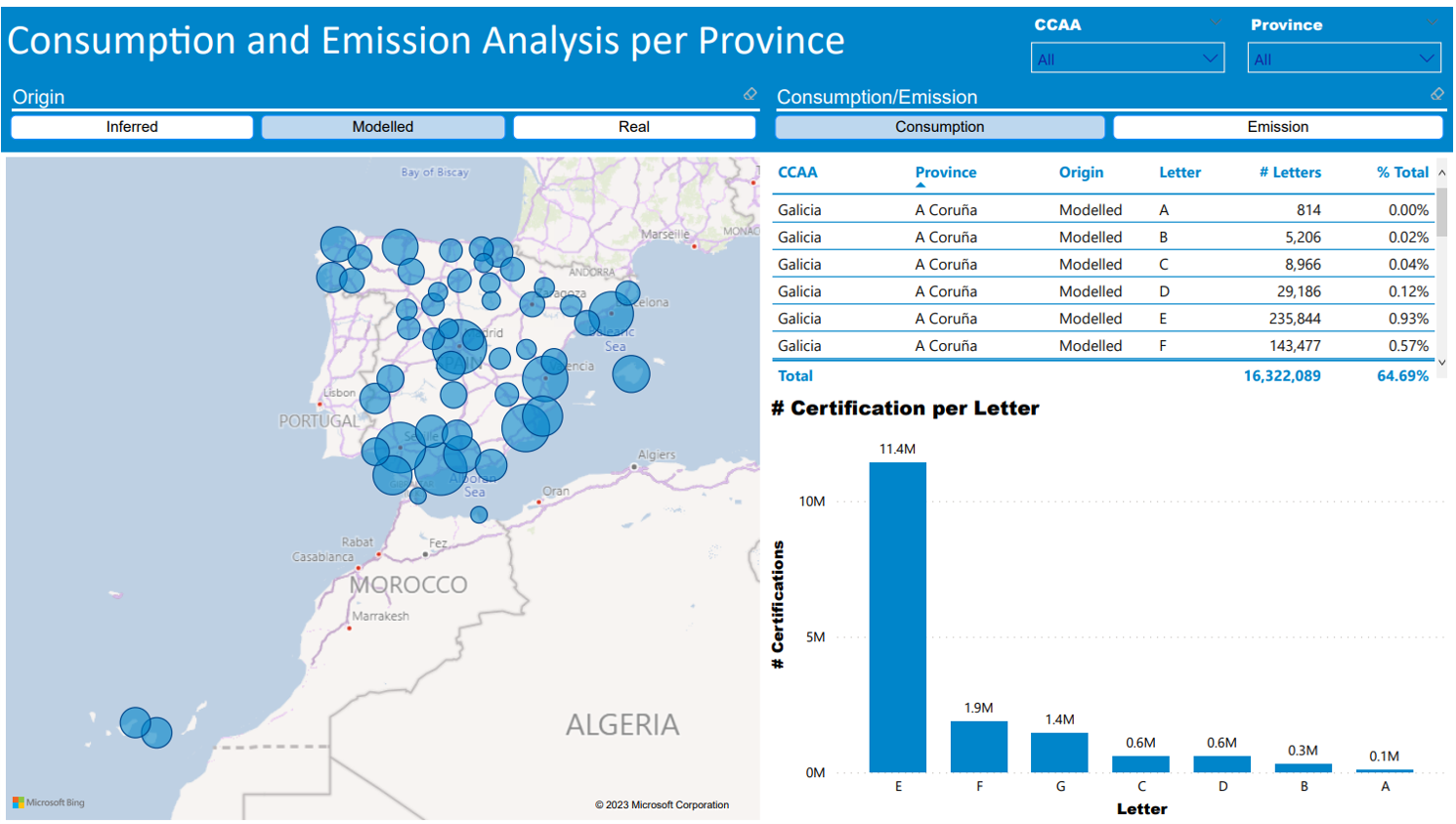

Tinsa offers an energy qualification for large banking portfolios through CO2 emissions (letter and figure) and energy consumption (letter and figure) using Spain’s largest energy certifications, technical due diligence and comparable assets databases.

The data we conduct our analysis on is based on real data, as well as inferred/modelled data:

- Tinsa’s CEE (real)

- Autonomous Community (CCAA) registry (real)

- Tinsa’s Data Bases, Cadastre y Deyde DataCentric (inferred/modelled data)

Thus, the data provided by DataCentric can be actual, inferred or modelled.

We have the most accurate model on the market with data from Tinsa’s property databases and energy efficiency certificates with 100% national coverage for residential real estate. The letter assigned (for non-actual data) is within +/- one letter in 85% of the cases, and 99.5% of the cases are within +/- two letters difference compared to the real energy certification.

Below you will find a model of the tool created by Deyde DataCentric for the cartographic visualisation of environmental certifications and consumption analysis.

Adaptation to Climate Change

The development of a model from our database provides a real, inferred or modelled value for 44 different variables that help us measure the impact climate change has on your business. This allows us to assign Tinsa or Consensual rating.

Why us?

We have an extensive network of real estate and environmental sustainability technicians and architects who are experts in real estate and environmental sustainability, which allows us to collect real quality data. Moreover, Tinsa alone covers c.30% of the national market allowing us to have the most complete and accurate real estate database on the market.

We have the analysts, data scientists and Big Data engineers that give us access to the largest and most diverse database of any real estate company to:

- Cleanse, normalise and validate data;

- Infer data;

- Model data.

DataCentric can help you have faster and more accurate mortgage/loan processing in compliance with ESG obligations generated by European Taxonomy and to achieve optimised timelines. Moreover, this process can help you obtain some of the available green funds regardless of the activity that your company is doing. Also, we are here to help you get one step closer to mitigating various risks arising from the possible economic impacts based on the market value of the property.

The team of experts and continuous improvements of our databases and models in use are here to be your long-term business partner, helping you get the best out of the fast-changing world based on data-driven decisions related to ESG. Request a meeting with our team of experts.

Business Development Manager