Spain’s consumption portrait evolves annually, reflecting changing consumer habits. This study analyzes Spain’s favorite brands for 2025–2026, presenting consumption maps by autonomous community across key sectors such as food and beverages, fashion, technology, automotive, and banking.

Through brand rankings, you can discover consumer preferences, the best-selling brands or brands with the greatest presence of physical outlets in each region and identify trends that will shape the market in the coming years.

Brands in Food & Beverage

1. Map of favourite beer brands in Spain 2025-2026 (1)

The beer market in Spain continues to transform, driven by growing demand for low‑alcohol and alcohol‑free beers—now a significant share of sales—and industry pressure to adopt more sustainable production and packaging models.

This year, there are barely any changes compared to the previous edition. Estrella Galicia conquers Melilla, reinforcing its leadership as the favorite beer brand with 42 % of votes, four points more than last year. Its expansion strategy and strong cultural ties to music and festivals underpin this leadership.

Mahou, with 14 %, loses one percentage point but remains in second place, continuing to be a major competitor with deep roots in Madrid and much of central Spain. It strengthens its connection with Spanish consumers through campaigns that evoke tradition and “the taste of sharing”, while innovating in alcohol‑free beers and new formats.

In third is Alhambra, gaining the podium with 8 %, confirming its growth and recognition in various territories. It reinforces its premium positioning through sensory experiences and its iconic 1925 variety—now one of the most valued in hospitality and key to boosting national visibility.

Notably, the top brands in national popularity (Estrella Galicia and Alhambra in first and third) do not correspond to their rankings in sales volumes, where both lag.

2. Map of favorite milk brands in Spain 2025-2026 (1)

The milk market faces transformation marked by challenges: structural drop in household consumption, pressure on production sustainability, logistics efficiency, and transparency in pricing for dairy farmers.

Consumer choice remains strongly territorial: local brands remain leaders in their regions of origin, such as Central Lechera Asturiana in Asturias, Kaiku in the Basque Country, Larsa in Galicia, or Hacendado in the Valencian Community.

At the national level, Hacendado takes the title of Spain’s favorite milk brand with 25 % of votes, overtaking Central Lechera Asturiana, with 24 %. Mercadona’s own brand achieves leadership thanks to its vast network of outlets and its perceived “quality at a good price.”

Meanwhile, the Asturian brand continues capitalizing on its image of natural origin and commitment to agriculture, emphasizing 100 % natural ingredients and a cooperative dairy structure that gives it strong legitimacy.

In third place is El Corte Inglés, with 20 % of votes. The brand connects with urban consumers who value trust in the distributor and an elevated perception of quality. In previous years it hadn’t led in any territories, but this edition sees it winning hearts in Madrid, Murcia, and Melilla.

This rise of the private label is notable, as it overtakes the territorial attachment of some traditional dairy brands.

3. Map of Favorite Coffee Brands in Spain 2025–2026 (1)

Sustainability and traceability are increasingly important in coffee: consumers value origin, fair trade certifications, and environmental responsibility. The growth of specialty coffee and cafés is also raising expectations, with consumers seeking a balance between quality, price, and social commitment.

In this context, Nescafé leads the ranking with 22 % of votes, becoming Spain’s favorite coffee brand. It tops the list in 11 of the 19 territories and remains a benchmark thanks to its broad offering in soluble coffee and capsules, and increases visibility through innovative formats like “KitKat by Nescafé Dolce Gusto” and “Starbucks by Nespresso,” both recognized as “Product of the Year 2025” by consumers.

The runner up is Marcilla, which—although leading only in 4 territories—gathers 20 % of total votes, very close to the leader. The brand strengthens its connection with Spanish consumers through purpose driven and emotionally resonant campaigns. In April 2025, it launched the #vecinencuentro initiative—an evolution of the “pending coffees” idea—to promote real encounters between neighbours in an increasingly digital world.

Third place goes to Saimaza, with 12 % of votes. It stands out for its heritage linked to Andalusian coffee tradition and for connecting with consumers seeking flavor and authenticity.

4. Map of favourite cured meat brands in Spain 2025-2026 (1)

The cured‑meats sector is undergoing normalization after years of adjustments. Consumers, now less price‑sensitive and more demanding on quality, seek authentic and sustainable products.

Casa Tarradellas remains atop the podium as the favorite cured meats brand in Spain, with almost 30 % of votes. Its leadership stems from firm commitment to quality, innovation, and tradition, backed by solid certifications.

El Pozo follows in second with 20.7 % of votes, losing ground in Extremadura to Navidul. Campofrío, with 15.6 %, closes the top three; it remains a preferred option, supported by its long history in the sector.

Palacios, which last year led in La Rioja and the Basque Country, has now become the favorite in Navarra.

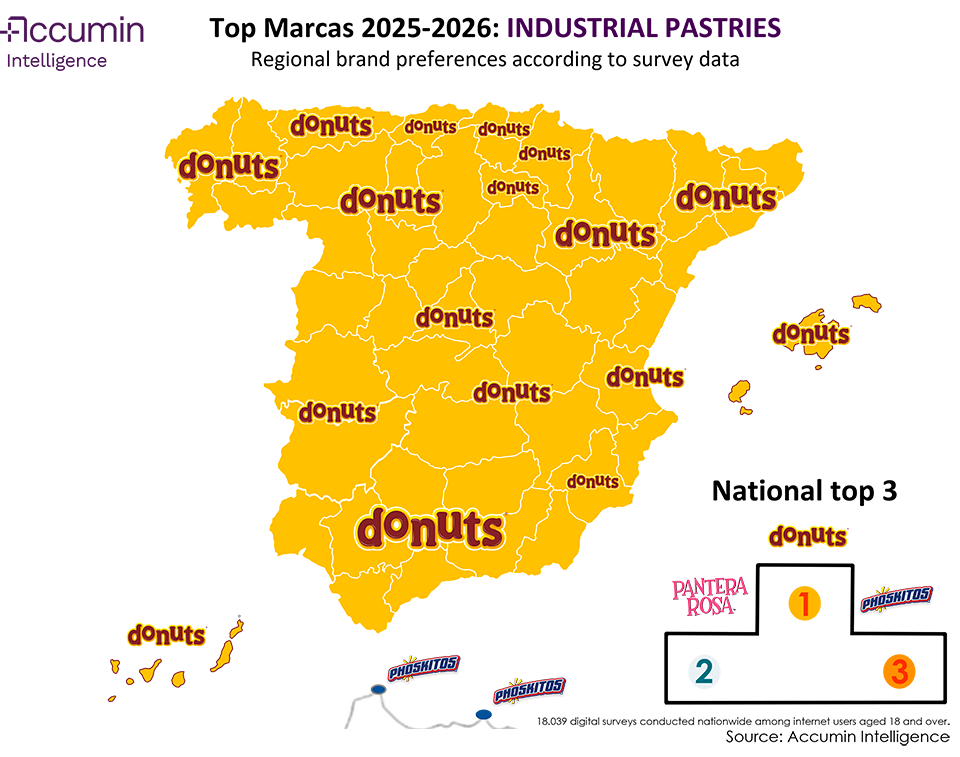

5. Map of Favorite Industrial Pastry in Spain 2025–2026 (1)

Industrial pastry remains an irresistible classic on many Spanish tables. Donuts continues as the clear favorite with 38 % of votes, winning in all autonomous communities except Ceuta and Melilla, where Phoskitos takes the lead.

In second place is Pantera Rosa, rising to 16.86 %, solidifying its position as one of the most iconic and nostalgia‑associated little cakes.

Completing the podium is Phoskitos, with 14.13 %, also winning over Melilla as a sign of its growing popularity.

6. Map of Favorite Soluble Cocoa in Spain 2025-2026 (1)

The soluble cocoa market remains quite stable, though it faces challenges and transformations. Consumers increasingly demand products with less added sugar and healthier formulas, pushing brands to innovate while appealing to younger demographics.

This year, ColaCao’s preference becomes even more evident. It rises to 65 % of votes, gaining 2 points over the previous year and solidifying an almost absolute leadership across Spain.

The exception is Nesquik, which manages to win in Extremadura, preserving its presence and remaining competitive with its main rival.

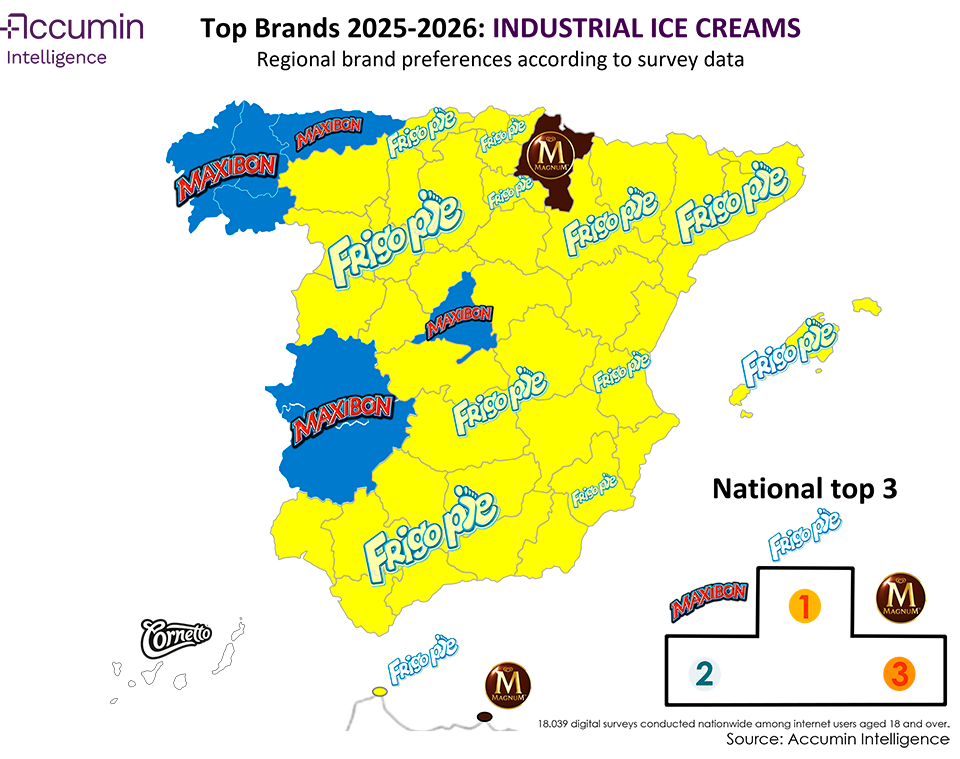

7. Map of Favorite Ice Creams in Spain 2025-2026 (1)

Summer 2025 has an unexpected protagonist: a timeless classic resurging strongly. Nostalgia has been a key driver this year, especially among older consumers, while cult brands return to prominence through emotionally charged, viral campaigns.

Frigopie has become the most popular industrial ice cream among Spaniards, with 21.89 % of votes, winning nearly across the entire national territory. This symbol of summer since the 1980s has reemerged with new energy after the nostalgic “Think of an ice cream” (“Piensa en un helado”) campaign guiding consumers on an emotional journey to their best past summers.

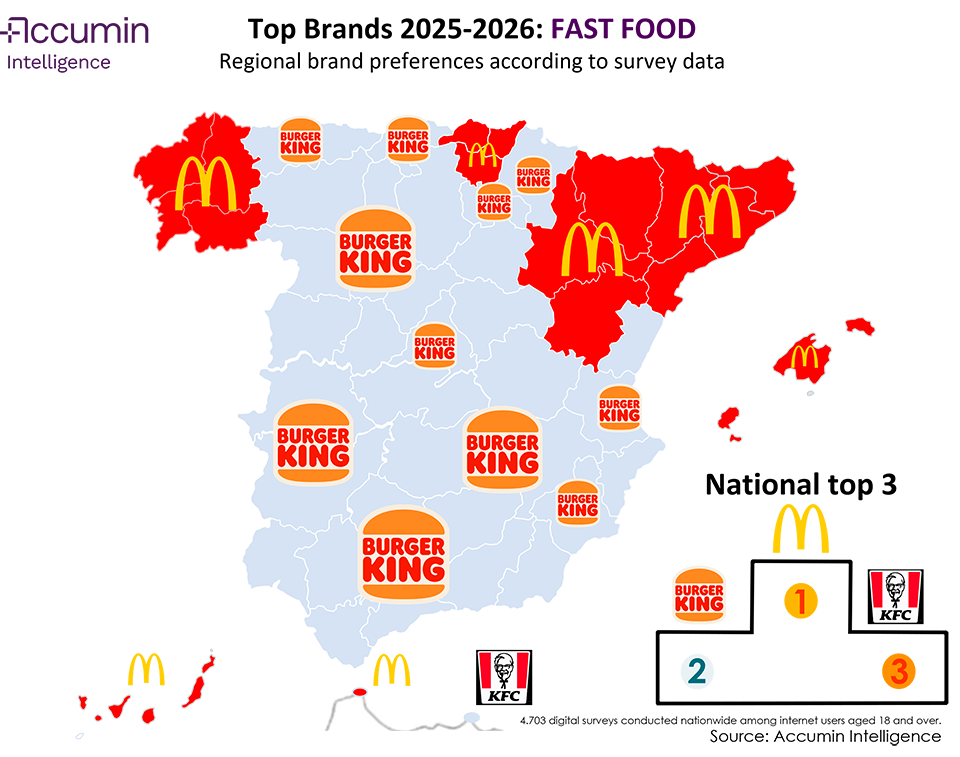

8. Map of Favorite Fast-Food Brands in Spain 2025-2026 (1)

The fast‑food sector in Spain is shaped now by the rise of delivery, digital platforms, and pressure to offer healthier, more sustainable options. Young consumers are a major part of the demand, valuing immediacy, attractive promotions, and variety.

As usual, the battle between the two major American burger chains—Burger King and McDonald’s—remains fierce in the national preference map. However, this year McDonald’s seizes the top spot at the national level, with its vote share rising two points to 27 %, surpassing Burger King, which drops by one point to 25 %.

McDonald’s bolsters its leadership through its focus on delivery, digital transformation of its outlets, and sustainability efforts such as eliminating single‑use plastics. Burger King, in turn, responds energetically with the expansion of drive‑thru formats and a steadily more diverse menu that includes plant‑based options.

Completing the podium is KFC, reclaiming third place and gaining ground by winning in Melilla, reaching 13 % of votes. Its success stems from the timeless appeal of its fried‑chicken recipe, sharply targeted youth campaigns, and new openings in key urban areas.

Brands in Retail and Consumer Goods

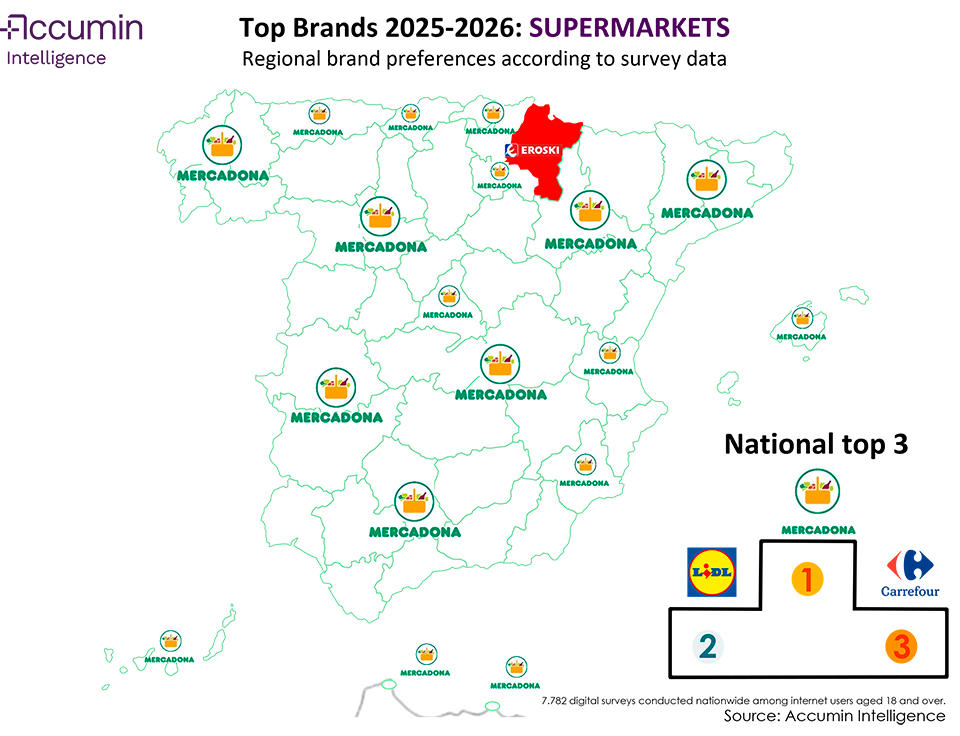

9. Map of Favorite Supermarkets in Spain 2025-2026 (1)

In the food retail sector, inflation and price pressures have made consumers increasingly cost‑conscious. As a result, private labels continue to gain prominence in shopping baskets.

Mercadona once again takes the crown as Spain’s favorite supermarket, maintaining near‑absolute dominance across the country, though Eroski manages to edge out a few territories in some communities.

Nationally, Mercadona leads with 39 % of votes—4 points up compared to the previous year—extending its lead over competitors. Notably, despite this, Mercadona doesn’t rank first in number of physical stores in any region.

Lidl, in second place with 20 %, sustains its growth via strategies that emphasize fresh product ranges, bakery departments, and positioning as a quality‑at‑lower‑price alternative.

Rounding out the podium is Carrefour with 13 %, which maintains efforts in omnichannel development, boosting its online channel, enhancing its loyalty program, and focusing on both hypermarket and urban‑supermarket formats with an emphasis on sustainability.

Even though Mercadona’s lead is expanding, competitors like Lidl and Carrefour hold relatively stable shares. The growth of the Valencian chain is largely due to drawing voters away from lesser‑known chains, thus enhancing its position without major losses from Lidl or Carrefour.

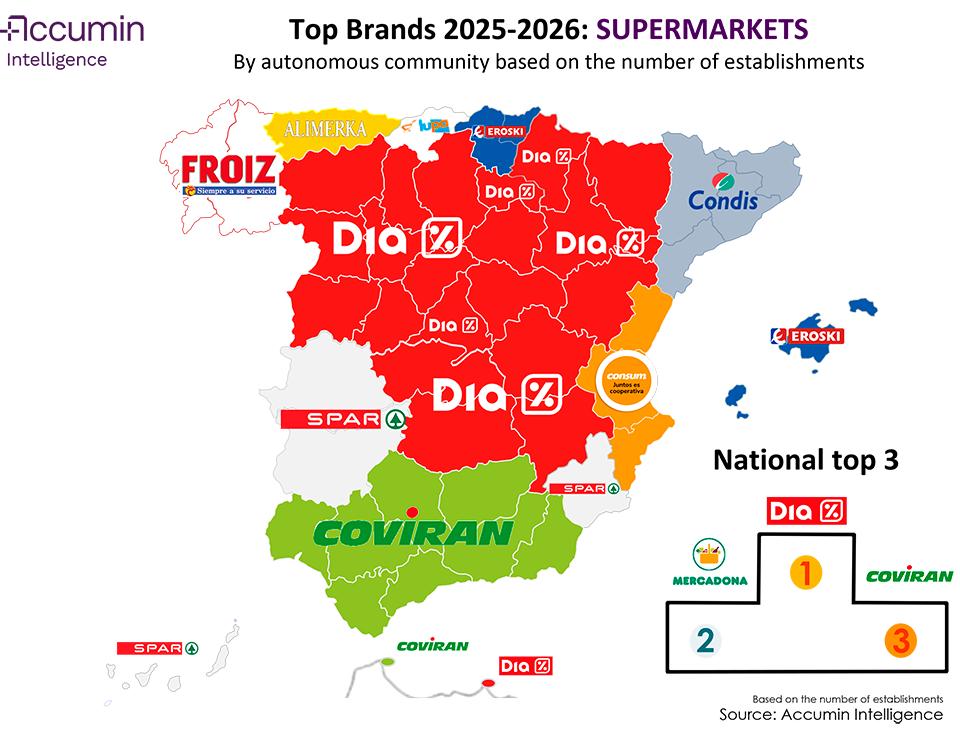

10. Map of Supermarkets by Number of Stores in Spain 2025–2026 (2)

Spain’s food distribution sector shows contrasts between surface growth, profitability, and differing physical presence strategies. Large chains are reinventing themselves with new formats, logistics expansion, and investments aimed at attracting modern consumers.

Día retains its position as the supermarket chain with the most outlets in Spain at 13.37 % of the total, although it loses presence in Catalonia and Asturias.

Mercadona climbs to second place with 7.28 % of all supermarket locations. The chain closed 2024 with record figures: a net profit of €1.384 billion (+37 %), after growing sales by 9 %, solidifying its reputation as the most profitable chain in the country.

Covirán falls to third with 7.17 % of total store count. While it remains on the podium, it faces competitive pressure from chains such as Lidl, Consum, or Aldi, which have demonstrated strong surface‑area growth in 2025.

Brands in Banking and Insurance

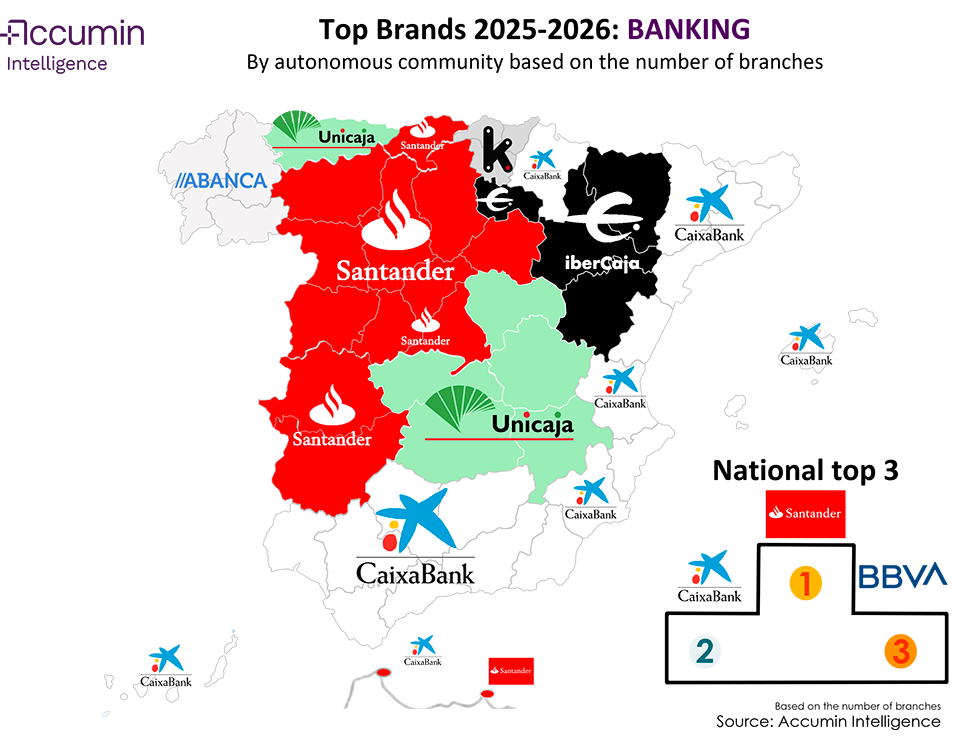

11. Map of Banks by Number of Branches in Spain 2025–2026 (3)

The competition for dominance in number of bank branches is less tight now. This year, Santander strengthens its lead with 23.43 % of all branches, leading CaixaBank (21.1 %) by more than two points. BBVA holds third place with 11.15 % of the national network.

The only territorial change in the map is in Navarra, where Caja Rural de Navarra is overtaken by CaixaBank.

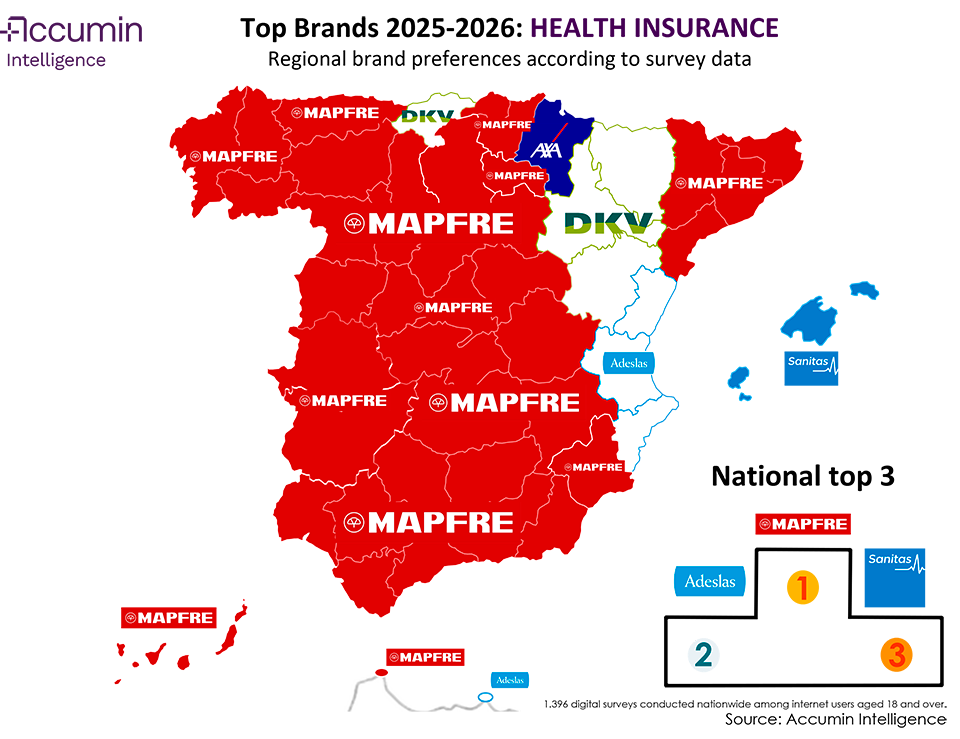

12. Map of Favorite Health Insurance Providers in Spain 2025–2026 (1)

The health insurance market in Spain continues to expand, driven by growing public concern for well‑being, preventative care, and rapid access to healthcare services. In this fiercely competitive space, major insurers vie for credibility through coverage, service, and reputation.

At the national level, Mapfre leads the ranking with 26 % of votes, although it loses four points compared to last year. This decline is reflected in the map, with lost presence in the Valencian Community, Aragon, Navarra, and Cantabria.

Adeslas climbs to second place with 16 %, despite losing leadership in the Balearic Islands, but becoming the top choice in the Valencian Community.

Sanitas holds third place at 12 %, maintaining its national presence despite losing ground in Murcia, while gaining in the Balearic Islands.

Brands in Motor and Energy

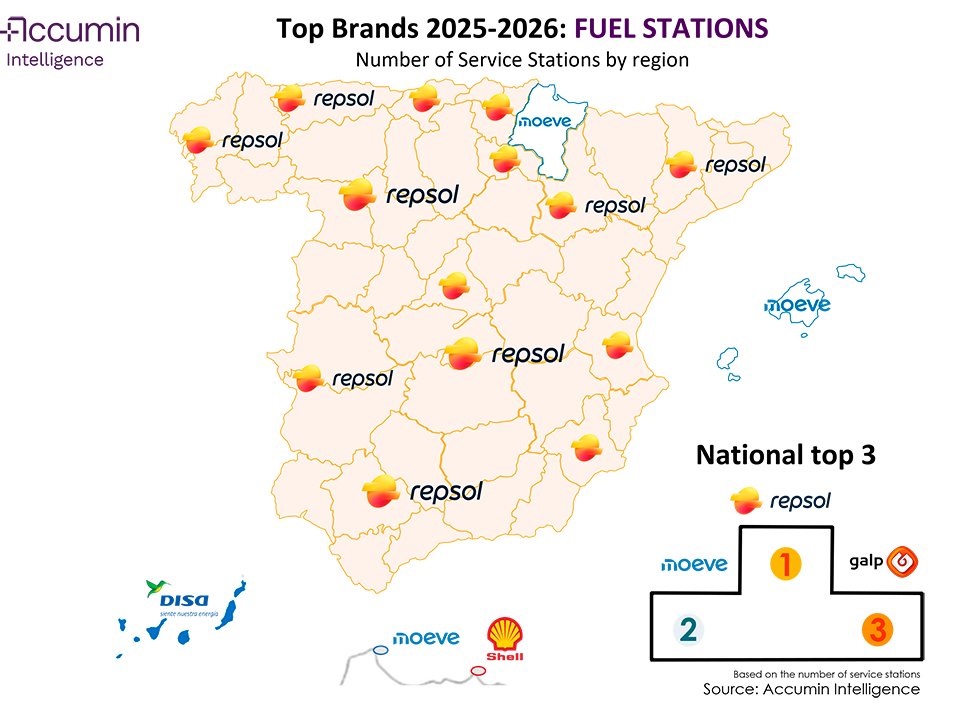

13. Map of petrol brands in Spain by number of gas stations 2025-2026 (4)

The Spanish fuel station sector is still led by long‑standing major brands, though the landscape is shifting. Repsol remains in first place, commanding 21.52 % of stations and regaining ground in Andalusia and Murcia.

Moeve (the new name for Cepsa since October 2024) comes in second with 15.37 %, while Galp takes third with 4.73 %.

Beyond these giants, independent and low‑cost fuel stations are growing and capturing more road‑network presence, forcing big brands to rethink competition strategies and driver outreach.

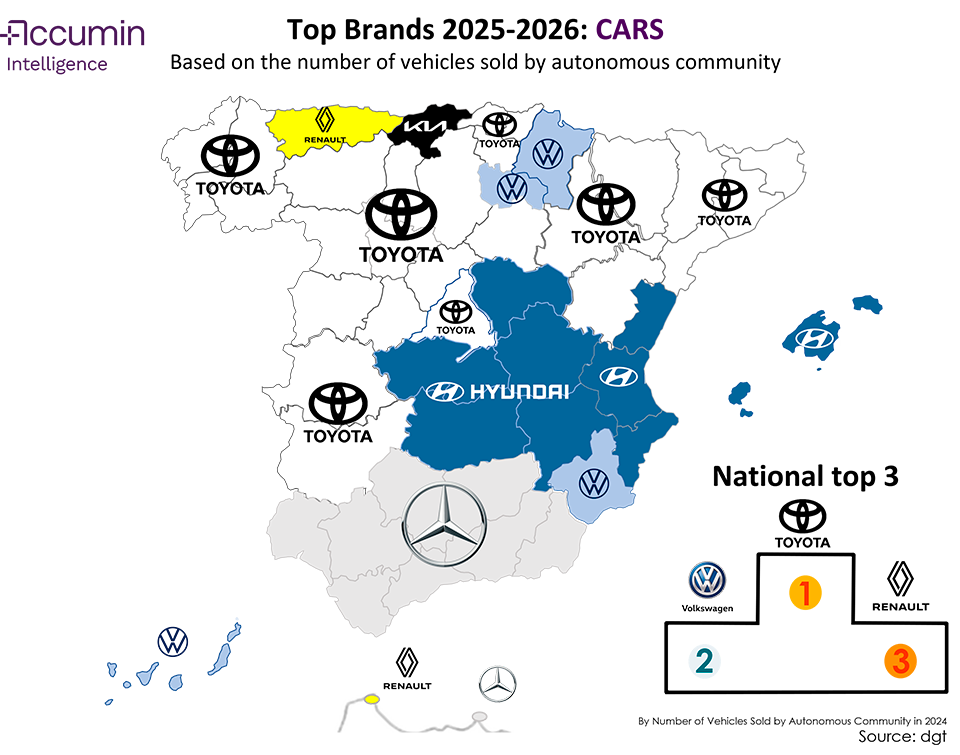

14. Map of Car Brands by Sales in Spain 2025–2026 (5)

The Spanish automobile market remains in a transitional phase fueled by electrification, digital transformation, and regulatory pressures.

Toyota consolidates its position as the best‑selling car brand in Spain with 9 % market share, despite losing 3 points from the previous year, and adding three new regions to its dominance.

Volkswagen, with 8 %, stays second, maintaining historically strong hold in Navarra and nearby territories.

Renault stages a comeback this year, gaining two new regions and landing third nationally with 6 %.

Also notable is the rise of Chinese manufacturers, now representing 4 % of the market—significant in a very fragmented space.

Notably, the Spanish consumer is not especially “brand‑loyal,” as at least half the regions tend to change their leader by sales year after year—this dynamism opens doors for Chinese brands to expand further.

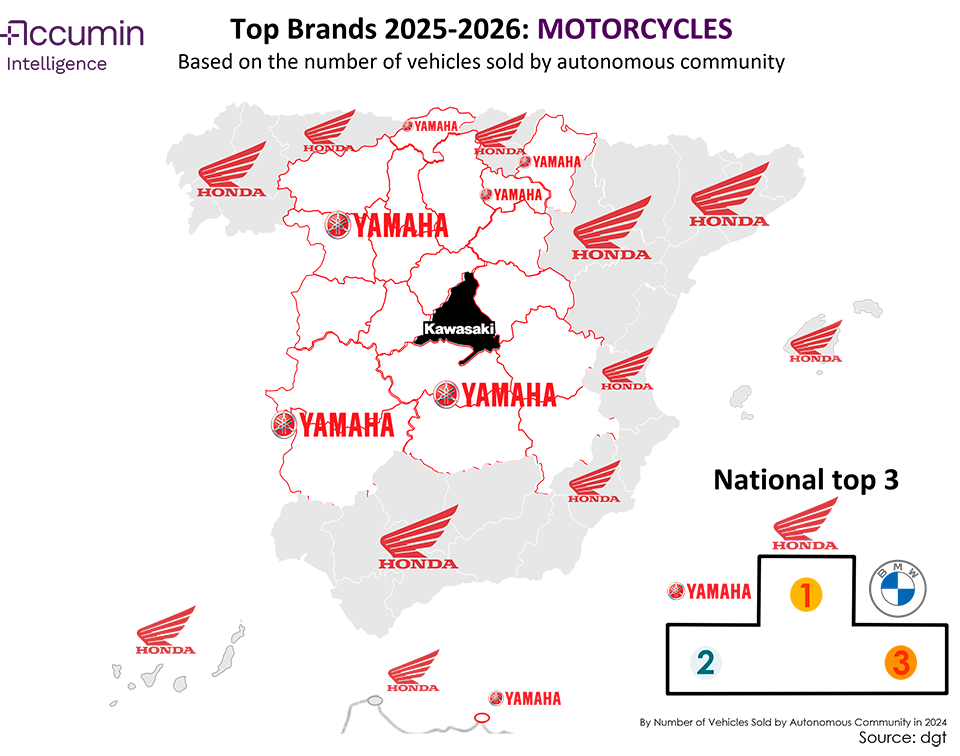

15. Map of Motorcycle Brands by Sales in Spain 2025–2026 (6)

Spain’s motorcycle market remains key for urban and leisure mobility. At the same time, the sector is gradually transitioning toward electric and connected models, though combustion still dominates.

Honda reaffirms its historic leadership, holding 21 % of national sales, backed by strong demand for scooters like the PCX and Forza, and a reputation for reliability.

Yamaha, second with 15 %, posts notable gains and wins in four additional territories, positioning itself as a stronger alternative with models such as the NMAX and TMAX that combine design, technology, and performance.

Perhaps the biggest surprise is BMW, which takes third nationally with 6 % market share; despite losing Castilla‑La Mancha compared to the prior year. Its strength comes from larger‑displacement and touring models like the R 1250 GS, favored by premium‑seeking riders focused on power and advanced tech.

Brands in Fashion & Lifestyle

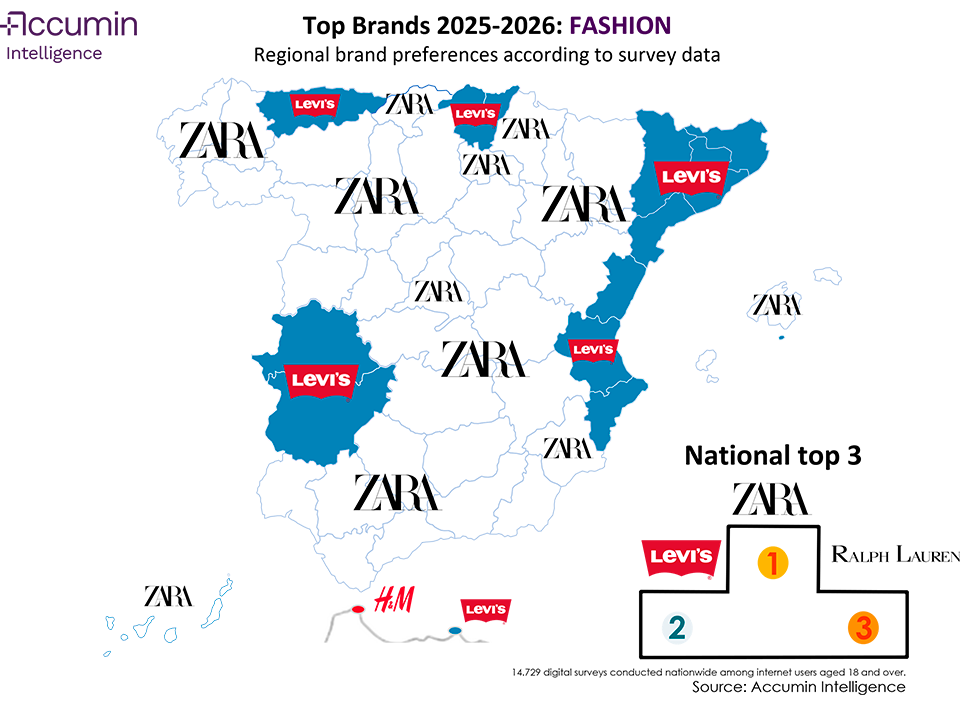

16. Map of Favorite Fashion Brands in Spain 2025–2026 (1)

The fashion market is evolving into an increasingly hybrid model, where fast fashion still dominates globally but increasingly coexists with growing consumer demand for sustainability, digital tools, and brand experiences.

AI‑driven design, personalization, and circular fashion (resale, recycling, second‑hand markets) are setting the agenda for leading labels.

Zara continues its dominance as Spain’s favorite fashion brand with 27 % of votes. The flagship of Inditex stands strong nationally, reinforcing its position through selective expansion, store modernization, diversification (e.g., Zara Man, Zacaffé cafés inside stores), and online presence—which already contributes 25 % to its revenue.

However, competition is tightening. Levi’s, with 21 %, maintains second place and this year gains the territory of Valencian Community and Melilla, although it loses Murcia.

The American brand leverages its strong European performance to cement a DTC (direct‑to‑consumer) strategy. It has bolstered its store network with initiatives like “CEO of the Store”, which empowers local managers, and a loyalty program that already contributes over 60 % of omnichannel sales in markets like the UK.

Ralph Lauren, with 9 %, rises to the national third place and is experiencing a positive moment in financial results thanks to a renewed global strategy.

17. Map of Favorite Sportswear Brands in Spain 2025–2026 (1)

Sportswear isn’t just about performance; it reflects lifestyle and personality.

Nike maintains a strong lead with 36.96 % of votes, reaffirming dominance in most autonomous communities.

Adidas, holding 24.25 %, preserves second place and gains ground: this year it becomes the favorite brand in Extremadura, Basque Country, and Navarra, winning back some territory from Nike.

The big novelty this year is The North Face, which climbs to third with 7.45 %, surpassing Puma. Its urban/outdoor fusion style especially resonates with younger generations.

18. Map of Favorite Flip Flop Brands in Spain 2025–2026 (1)

Flipflops, once tied specifically to beach wear or home, are now a staple in urban fashion. ‘90s‑inspired platform designs have made a comeback, while luxury brands are even selling pairs over €700—part of the “quiet luxury” trend where simple‑looking items become aspirational.

Adidas reigns as the favorite flip‑flop brand across almost all autonomous communities, except two highly summery territories. In the Canary Islands, Ipanema leads, while Havaianas is favorite in the Balearic Islands.

Nationally, Adidas holds the top position with 36 % of votes, driven by nostalgic Adilette designs that blend sporting heritage with functional design.

Havaianas is second with 21 %, strengthening its global presence through fashion collaborations, co‑branding, and signing Gigi Hadid as ambassador—boosting its summer visibility with a 51 % increase in Pinterest searches.

The bronze goes to Crocs with 15 %, though it doesn’t win in any territory. It continues to grow thanks to ergonomic innovation, despite mixed opinions on aesthetics, and a new wave of virality via TikTok “Miami Flip Flops” models.

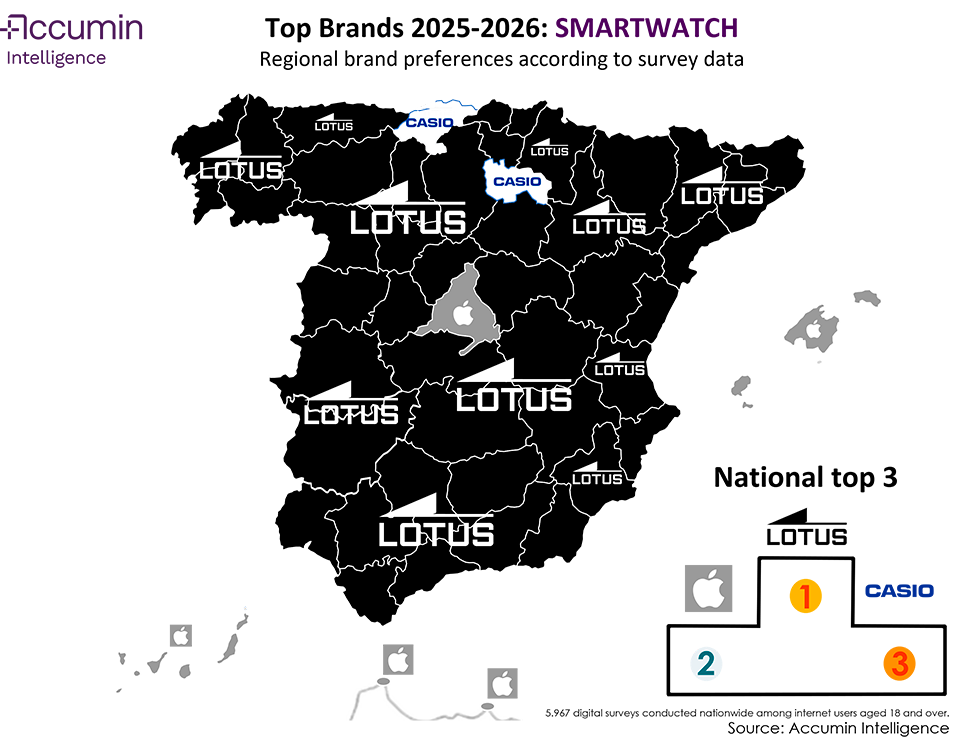

19. Map of Favorite Watch / Smartwatch Brands in Spain 2025–2026 (1)

Spain’s watch and smartwatch sector reflects a coexistence of time-honored craftsmanship and cutting-edge technology.

Lotus strengthens its leading position with 23.8 % of votes, expanding its dominance into Asturias, Basque Country, Extremadura, and Valencian Community.

Apple, with 19 %, holds a firm second place, though it loses territorial hold to Lotus and to Casio, which becomes favorite in Cantabria.

Securing third with 14.4 %, Casio reinforces its appeal with reliable, timeless designs.

Brands in Technology & Entertainment

20. Map of Favorite Telecom Brands in Spain 2025–2026 (1)

The merger of Orange and MásMóvil in 2024 reshaped the competitive map, prompting other firms to intensify initiatives in an increasingly homogeneous sector.

Despite this, Movistar remains the undisputed leader, holding steady in number of territories and climbing two points nationwide to 25 % of votes.

The second spot is taken by MasOrange (post-merger), consolidating its strength with 18 %, becoming a serious alternative in the market.

Vodafone is close behind, with 16 %, edging forward by winning one additional territory, but failing to significantly close the gap.

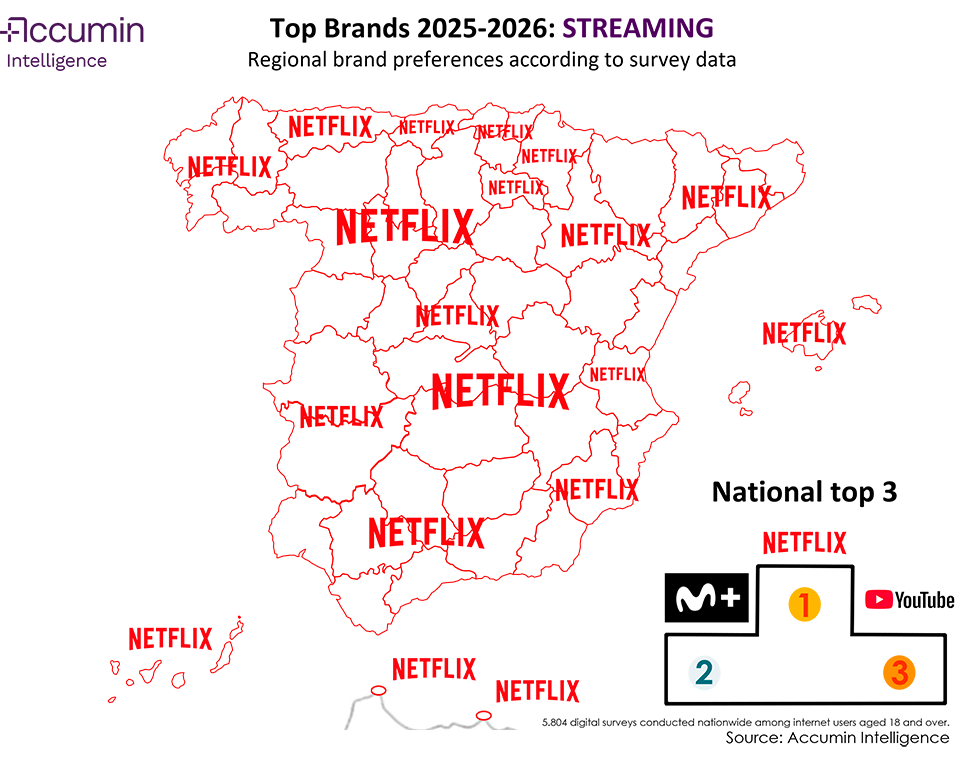

21. Map of Favorite Streaming Platforms in Spain 2025–2026 (1)

Streaming is no longer just an alternative to TV—it’s the central hub of entertainment in Spanish homes. Recent data indicates that 60 % of households pay for at least one streaming service, and one in three subscribes to multiple platforms.

Netflix continues to dominate, with 47.7 % of votes and leading in every autonomous community. Beyond its usage, Netflix reaffirms its commitment to Spain with an announced €1 billion investment between 2025 and 2028 to support local content and audiovisual infrastructure.

Movistar+ maintains second place with 14.66 %, fueled by a mix of local fiction, exclusive series, and live sports.

In third is YouTube Premium with 13.5 %, overtaking Prime Video. This shift likely stems from increased Smart TV ad use and the convenience of having YouTube Music included in the subscription.

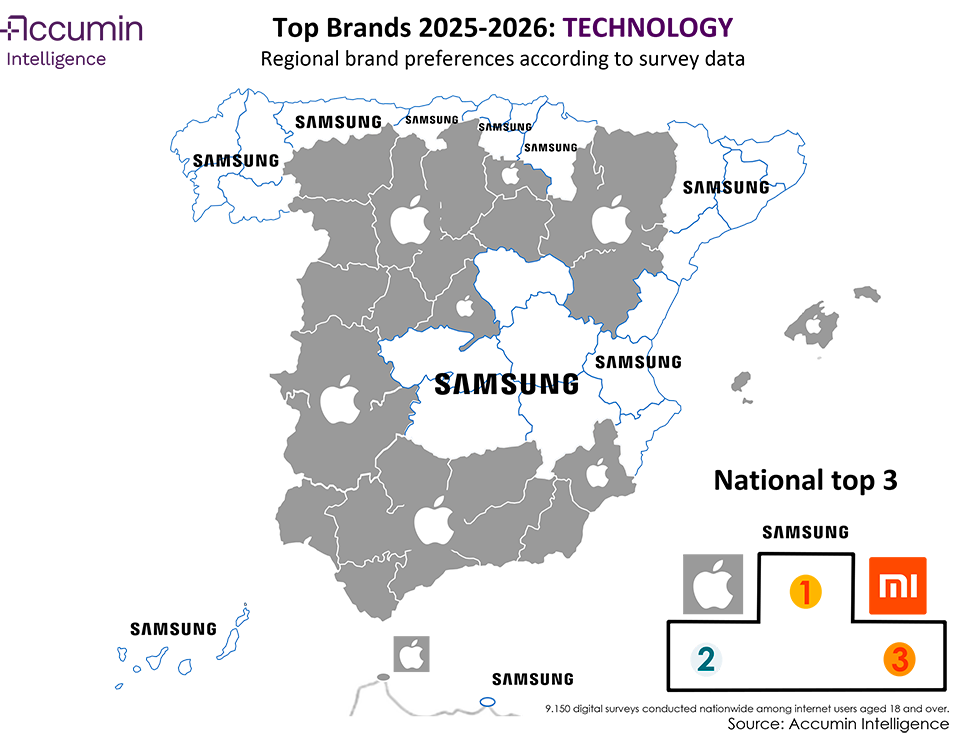

22. Map of Favorite Technology Brands in Spain 2025–2026 (1)

The competition for top spots in the tech sector is close, revealing a shift in consumer preference maps.

Samsung holds the lead with 24.17 % of votes but is closely trailed by Apple at 23.92 %.

Xiaomi secures third place with 15.18 %.

On the map, Apple becomes the favorite brand in multiple regions: Aragon, Extremadura, La Rioja, Castilla y León, Madrid, Andalusia, Murcia, Balearic Islands, and Ceuta—stealing outright majorities from Samsung.

Brands That Inspire Trust in Consumers

23. Map of Brands That Inspire the Most Trust in Spain 2025–2026 (1)

This is the second year included in the study examining which brands Spaniards trust most. The results show that brand loyalty is shaped not only by product quality but also by reputation, local presence, and value‑alignment.

El Corte Inglés remains first in trust, collecting 23 % of votes nationally, though Amazon narrows the gap—becoming the top choice in Castilla y León, Extremadura, and Valencian Community, thanks to its strong online presence.

At the national level, Amazon registers 15.24 %, cementing second place.

A major surprise this year: Estrella Galicia jumps into third place with 11.98 %, surpassing Apple and highlighting the power of local brands with cultural identity and deep roots.

The map also reveals other interesting movements: Nestlé becomes the trusted brand in Cantabria, and Google in the Balearic Islands, underscoring regional brand diversity and the importance of meaningful local connections.

If you are interested in disseminating or using these maps for free, you can do so freely by linking to us and using the hashtag #SpainTopBrands2025 on networks.

1) Based on the results of digital surveys, generated through competitions, of a national sample of internet users over the age of 18 (Source: Accumin Intelligence – January 2024 – July 2025).

(2) Ranking of top supermarkets based on the number of establishments in the MarketBase database (Source: Accumin Intelligence – July 2025).

(3) Ranking of top banks based on the number of branches in the MarketBase database (Source: Accumin Intelligence – July 2025).

(4) Ranking of top oil companies based on the number of service stations per business group in the MarketBase Database (Source: Accumin Intelligence – July 2025).

(5) Ranking of best-selling car brands by region, according to data compiled by the Directorate-General for Traffic (2024).

(6) Ranking of best-selling motorcycle brands by region, according to data compiled by the Directorate-General for Traffic (2024).